what is tax planning explain its importance

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. OBJECTIVE OF TAX PLANNING.

2022 Eisneramper Tax Planning Guide

Want to know more about why tax planning is important.

. In other words you want to reduce what you owe on your tax bills by taking advantage of any allowances exclusions exemptions. Here are the key advantages of tax planning. It is a continuing process where you and your accountant analyze your.

Discuss the objectives importance and types of tax planning. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and. Tax planning is a way to find out how much money you are paying on tax and also a way to help minimise the tax liability the amount owed to tax authorities through the use of.

By planning ahead and working with a property tax consultant early on before your tax statement hits the mail you have a better chance of reducing your propertys appraised value. Remember tax planning is a completely different concept than filing your taxes. Most people think that tax planning is just a rough draft of your tax return that we use to project out what your tax liability is going to be in April.

Income tax planning reduces an assessees tax burden by organizing their financial activities under tax choices. It basically means being responsible with your. Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity.

Tax planning refers to the process of minimising tax liabilities. What is Tax Planning. Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does.

Tax planning reduces tax liabilities by saving the maximum amount of tax by arranging and. Ad Browse Discover Thousands of Business Investing Book Titles for Less. What is Tax Planning and its Importance.

This is why you require tax planning. Tax planning is essential as. Tax planning is much more than preparing current year income tax return.

What Exactly is Tax Planning. Tax planning is the logical analysis of a financial position from a tax perspective. Contact a Fidelity Advisor.

Tax Planning is Not Tax Preparation. Thoughtful tax planning is vital for any wealth-management strategy. Our Business Consultants Will Partner With You To Build Financial and Operational Success.

Objectives of Tax Planning Tax planning in fact is an honest and rightful approach to the attainment of. Tax planning is a process of analysing and evaluating an individuals financial profile. Ad Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want.

The basic objective of tax planning is to reduce the burden of tax liability and induce the insurance of taxation and budgetary efficiency. Understand the objectives of tax planning in India and its various types along with their benefits and importance. Tax filing is simply preparing and sending in your tax.

The aim of this activity is to minimise the amount of taxes you pay on your personal. It can help you save for your childs education or a retirement fund grow your small business maximize your income and. Tax planning facilitates the smooth functioning of the financial planning process.

Compliance regarding tax payment reduces legal hassles. Additionally it complies with applicable tax rules decreasing the. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

What do you mean by tax planning explain its importance. What is tax planning. Know more by clicking here.

Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc. One thing we also know is that tax planning is VITAL to creating a flow of income in retirement that is FREE from or at least minimizes your tax liabilities when living on a retirement income. Tax planning is no rocket science.

Contact a Fidelity Advisor. Tax planning means reduction of tax liability by the way of exemptions deductions and benefits. As mentioned above tax planning seeks to eliminate tax contingencies increase a companys profits or reduce tax payments all by using the respective legal mechanisms.

Tax Planning Know Scope And Importance Of Corporate Tax Planning

Tax Planning While Setting Up New Businesses

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

Importance Of Tax Planning For Corporates And Individuals

Why Is Human Resource Planning Important Itchronicles

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

Tax Planning In India With Types Objectives

What Is Financial Planning Types Meaning Objective Importance Faqs

What Is Tax Compliance Northeastern University

Tax Planning For High Net Worth Individuals Bmo Private Wealth

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

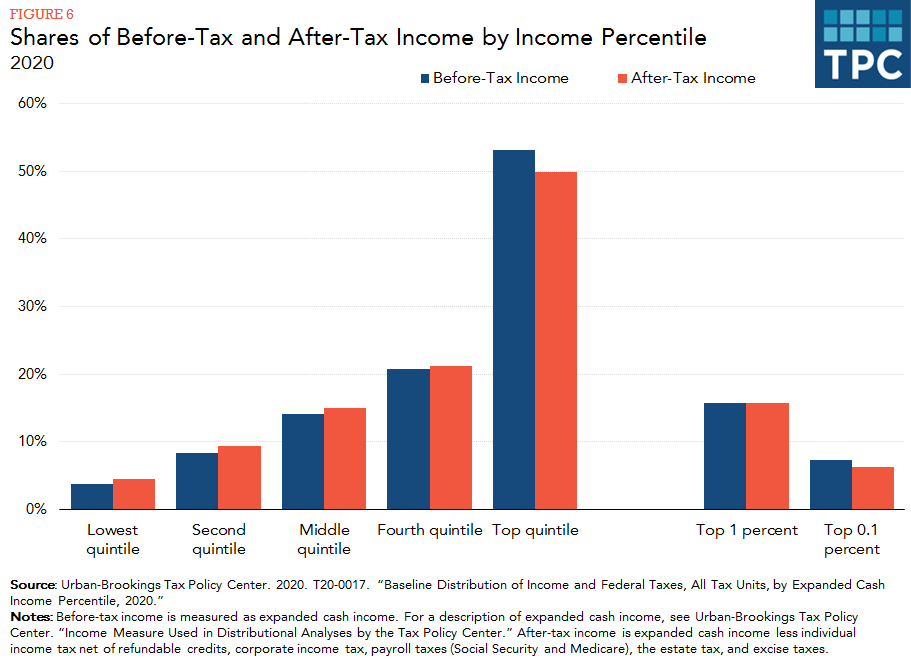

How Do Taxes Affect Income Inequality Tax Policy Center

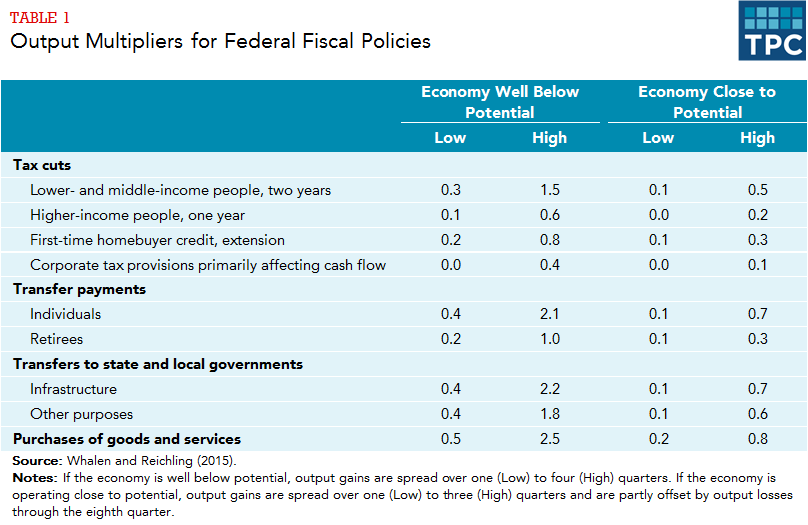

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Bayer S Approach To Tax Bayer Global

What Is Income Tax Income Tax Planning It Returns Income Tax Slabs

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)