oregon 529 tax deduction 2019 deadline

Oregon 529 tax deduction 2020 deadline. Families can deduct up to 4865 worth of these contributions from their state tax.

/GettyImages-936317872-35f1a1c79a9a4545ad7f71f05707338b.jpg)

529 Plan Contribution Limits In 2022

If you currently take advantage of this option you are able to carry forward.

. 100 units will always equal one year of tuition. Every year the GET program determines the price of a unit. 529 plan contributions are not deductible from federal income tax but over 30 states offer a state income tax deduction.

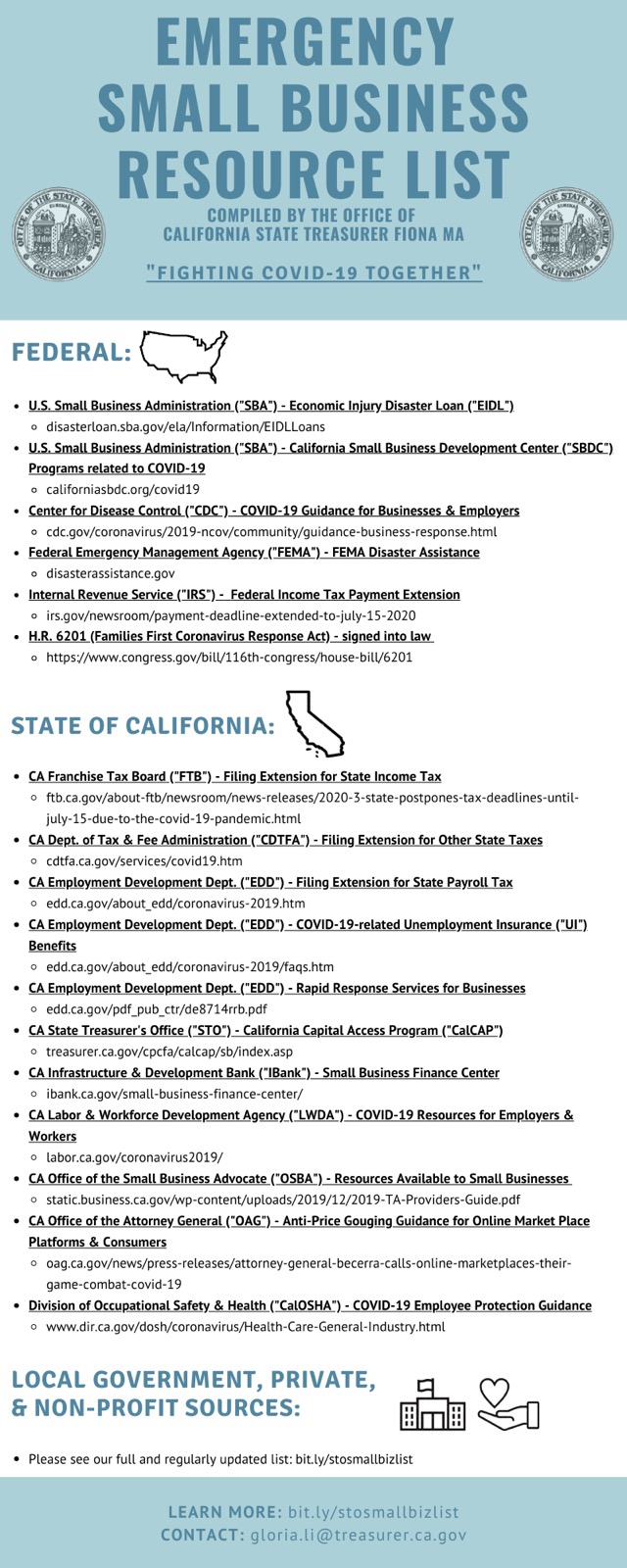

The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. The Oregon College Savings Plan is moving to a tax credit starting January 1 2020. If you file an Oregon income tax return contributions made to your account before the end of 2019 are.

Contribution deadlines for state income tax benefits. Oregon 529 tax deduction 2020 deadline. Tax deduction procedures for 529 tactics.

This income tax funds public transportation services and improvements within Oregon. Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon. Oregon 529 Plan And College Savings Options.

100 units will always equal one year of tuition. Rollover contributions up to. State tax benefit.

The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. If you currently take advantage of this option you are able to carry forward. The tax is equal to one-tenth of 1 percent 01 or 0001 of the wages received by an.

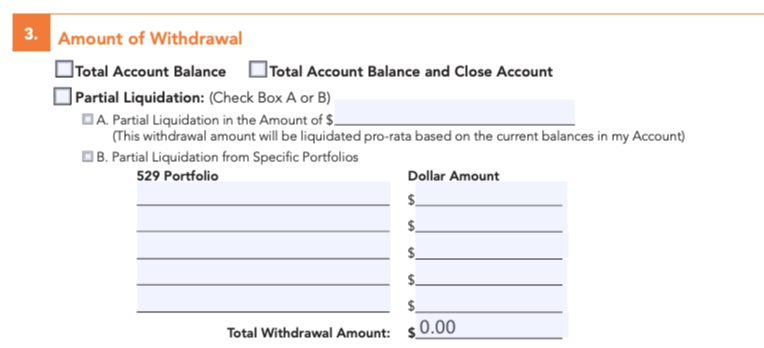

Most states have a December 31 contribution deadline to qualify for a 529 plan tax deduction. Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income. Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon College Savings Plan Direct Deposit for Personal Income Tax Filers Submit original formdo not submit.

I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. Oregon 529 Tax Credit 2020 Oregon 529 Deduction Limit How to login easier. At the end of 2019 I contributed 24325 to carry forward.

529 Plan Advertisements And Marketing Collateral

529 Plan Maximum Contribution Limits By State Forbes Advisor

529 Plans Which States Reward College Savers Adviser Investments

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Officials Say New Mexico S 529 College Savings Plan Underused Business Santafenewmexican Com

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 Plan Advertisements And Marketing Collateral

So You Re Going To Miss The Tax Filing Deadline Now What Thestreet

How To Use A 529 Plan For Private Elementary And High School

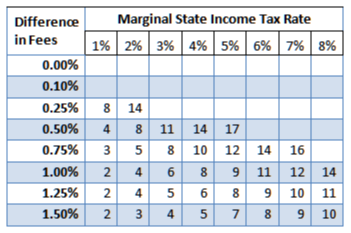

When Is A State Tax Break Better Than Lower Fees On A 529 Plan

529 Plan Deductions And Credits By State Julie Jason

Tax Benefits Oregon College Savings Plan

529 Plan Withdrawal Rules How To Take A Tax Free Distribution

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

Tax Newsletter May 2020 Covid 19 Updates Basics Beyond

The Most Important Thing To Do With Your 529 Before Year End

What Are The 529 Plan Contribution Limits For 2022 Smartasset